Accounting for Amazon Sellers: The Keys to Profitability

A detailed income statement report like this gives you an overview of how much you’re spending in comparison to how much you’re earning. Not how much revenue you generated in sales, but how much you earned in profit. Sage 50 has three plans available, either as a monthly or annual billing option. Prices vary based on the number of users and available features. It scored a little lower than QuickBooks and Sage 50 in customer support because of its lack of support from independent bookkeepers.

You won’t need to worry about it being done, done on time, and done correctly. Plus, outsourcing this task allows you to focus on other aspects of your business that you likely find more enjoyable, such as product development and marketing. The journal entries to issue stock main weaknesses we found with Xero include its lack of customer support and underwhelming mobile app.

Products and Services

I will probably ask my supplier for 5% more units in the next shipment, free of charge, to cover quality-related returns. Enterprise-level tools to improve profitability and fuel multi-brand growth. Boost efficiency and save time with tools to automate your business. Another way to grow your customer base is by improving your product listings. Make sure your product listings are optimized with accurate descriptions, high-quality images, and competitive pricing.

That is great news, but it could also affect inventory readiness. Clearly, demand for this product is growing, so it might be time to contact the supplier and boost production to avoid an inventory stockout. Tip – Fetcher has a daily inventory tracker and projection tool on the dashboard page. Keep in mind that not all expenses are deductible, so it’s important to consult with a tax professional to ensure that you’re taking advantage of all the deductions you’re entitled to. COGS is the direct cost of producing or acquiring the products that you sell. It includes the cost of materials, labor, and overhead that are directly related to the production or acquisition of your products.

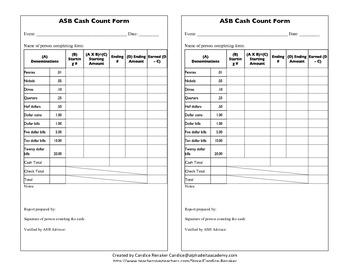

One way to make closing the books easier is to use a spreadsheet to track your income and expenses throughout the year. This can help you stay organized and ensure that you don’t miss any deductions. You can also use accounting software to automatically reconcile your accounts and generate financial statements.

The settlement amount includes a mix of sales, fees, refunds, taxes, and other transactions. It’s crucial to break down these transactions and record them accurately in your Chart of Accounts. Any business owner knows that cash flow is essential, but that can be hard to get a good gauge on, too.

How to start a dog daycare business

- As you start to stock more SKUs, you may want to migrate to inventory management software to help with this task and keep you on track.

- He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University.

- You should also register for a sales tax permit in each state where you have a sales tax nexus.

- Sage 50 also scores well for customer support, with the most customer support options of any software on our list.

- Cloud accounting software, like Xero, is great at automatically syncing all of your bank transactions to your feed.

- Take that starting cash balance and consider the flow of cash to the 3 major areas of your business.

Proper accrual accounting requires revenue to be recognized when it is earned, regardless of when the payment is received. This means you should record sales that occurred in August within August and sales from September within September. The primary factor we looked for in inventory accounting was a perpetual inventory system that automatically calculates and records COGS every time a sale is made. We also liked platforms that allowed you to easily view inventory on hand and the cost per unit of inventory. Additional points were given for the use of purchase orders and the ability to add returned merchandise back into inventory. We evaluated each provider’s pricing for one, three, and five users.

Properly categorizing each component of the settlement ensures compliance, accurate financial reporting, and a clear understanding of your business’s true financial health. Mismatches in revenue tracking can lead to inaccurate financial reporting. For payroll entries instance, if there’s a mismatch between tracking revenue and the Cost of Goods Sold (COGS), it can distort your profit margins. Ensuring that revenue and expenses are recorded in the correct periods helps maintain accurate financial records and provides a true picture of your business’s financial performance. Regularly updating and monitoring your records means you’ll have less paperwork to get done during tax season.

Managing Finances and Cash Flow

To ensure compliance with sales tax laws, it’s essential to keep accurate records of your sales and tax obligations. You should also register for a sales tax permit in each state where you have a sales tax nexus. Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. the grateful dead attend their first acid test on this day in 1965 from Penn State.

Your P&L is a report that allows you to quickly see all of your revenue and expenses in a given time period. When you run into problems, this can range from cash flow shortages, late payments to suppliers, or payroll problems. It doesn’t make sense to advertise a product that doesn’t have a high return. Instead try coupling that product with one of your better-selling SKUs, to generate attention, and eventually sales. Save yourself hours of accounting admin so you can focus on growing your business.